The FATF

-

Activities

- The FATF (Financial Action Task Force) meetings

-

The FATF consists of 38 jurisdictions (including Japan) and 2 regional organizations and the FATF Plenary meets three times a year, usually in February, June and October.

The FATF Plenary was held in February 11-13, 2026.

For details, see the FATF website (in English)See: Outcomes FATF Plenary, 11-13 February 2026

See: Earlier FATF Plenary meetings - FATF Statement

-

At the Plenary meeting held in February 11-13, 2026, the FATF adopted a statement on high-risk jurisdictions that have significant strategic deficiencies in their regimes to counter ML, TF, and PF (High-Risk Jurisdictions subject to a Call for Action) which was published on February 13, 2026. At the meeting, a document titled Jurisdictions under Increased Monitoring was also adopted and published on February 13, 2026.

See the following:

《High-Risk Jurisdictions subject to a Call for Action》 February 2026

《Jurisdictions under Increased Monitoring》 February 2026

Earlier public statements issued by the FATF, etc. - History of the FATF

-

By the 1980s, the international community had a sense of crisis regarding the global spread of drug problem and took various actions. Particularly, it was viewed as important to crackdown financial sources of international drug trafficking organizations by confiscating proceeds from drug production and trafficking and by controlling ML. At the Arche Summit in July 1989, major developed countries took leadership in creating the FATF to enhance international cooperation in countering ML regarding drug crime.

As the global spread of organized crime was recognized as threatening national safety in the 1990s, the Halifax Summit in June 1995 concluded that measures should be taken to prevent the concealing of proceeds from serious crime as well as drug transactions to counter international organized crime.

Scope of the FATF Recommendations

After the terrorist attacks of September 11, 2001, the FATF held an emergency meeting in October 2001, and decided to incorporate CFT measures into its mission and to set the 8 Special Recommendations (the FATF Recommendations on terrorist financing) calling for criminalizing terrorist financing, freezing terrorist assets, and other measures as international standards for CFT.

The concept of Countering Proliferation Financing (CPF) was added to the revised FATF Recommendations agreed in 2012.

In this way, the FATF Recommendations have been revised as needed based on new risks and international requests to respond to the diversification of methods of ML/TF/PF.

- FATF 40 Recommendations

-

In April 1990, the FATF formulated its 40 Recommendations to provide standard AML that each country should take in law enforcement, criminal justice and financial regulations areas to harmonize the measures taken in each jurisdiction. The 40 Recommendations called for the early ratification of the UN Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, the development of domestic legislation to control ML, FIs’ confirmation of customers’ identity and reporting of suspicious transactions, and other measures.

In June 1996, the 40 Recommendations were partially revised to expand the scope of predicate offences to include serious crime in addition to traditional drug crime. In October 2004, a recommendation on measures to prevent physical cross-border transfers of cash was added to the 8 Special Recommendations, resulting in the 9 Special Recommendations.

In June 2003, the 40 Recommendations were revised to apply the recommendations to DNFBPs. In February 2012, the 40 Recommendations and the 9 Special Recommendations were integrated into the new 40 Recommendations to respond accurately to threats such as the proliferation of weapons of mass destruction and corruption among public servants, including bribery and embezzlement.

- Mutual Evaluation Standards and Process

-

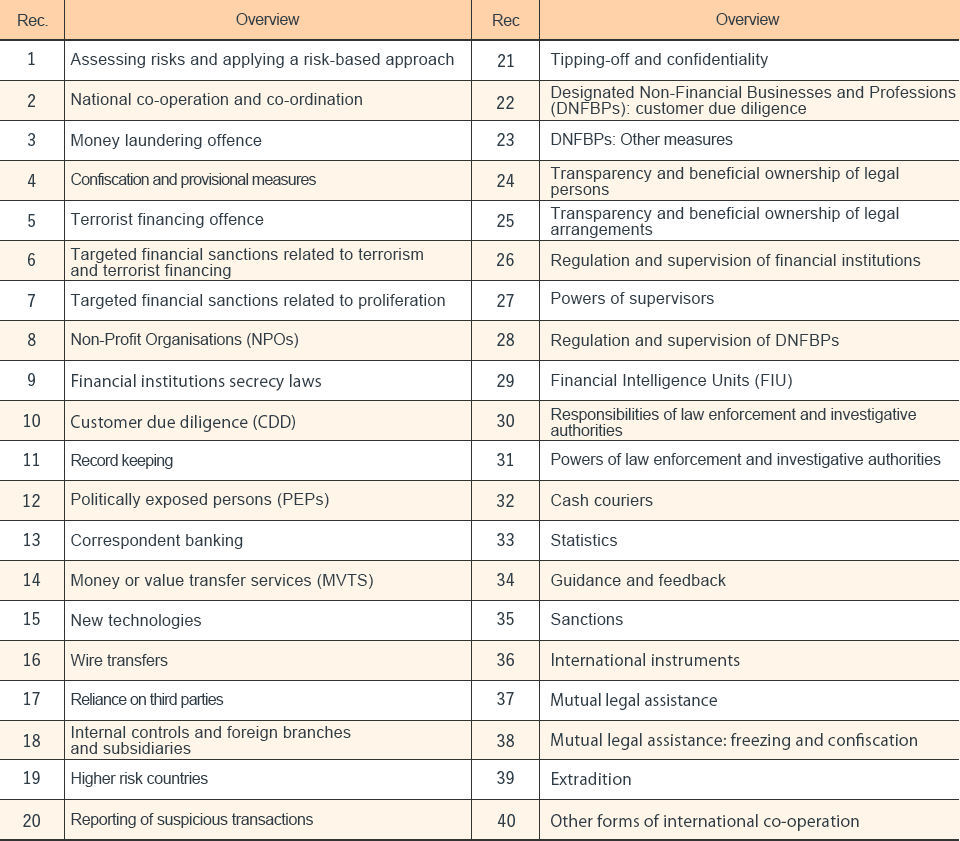

Based on the 40 Recommendations and 11 Immediate Outcomes, FATF members mutually assess their AML/CFT/CPF measures.

Under the 40 Recommendations, the technical compliance of AML/CFT/CPF is evaluated.

FATF 40 Recommendations (for the fourth round of mutual evaluation)

(Note 1) DNFBPs (Designated Non-Financial Businesses and Professions) are (a) Casinos, (b) Real estate agents, (c) Dealers in precious metals, (d) Dealers in precious stones, (e) Lawyers, notaries, other independent legal professionals, and accountants within professional firms, (f) Trust and Company Service Providers (those that fail to be included into other industries and mediate the incorporation of enterprises).

(Note 2) The FIU (Financial Intelligence Unit) is a government agency that centrally receives and analyzes information on money laundering and terrorist financing and disseminate analysis results to investigation authorities.

(Note 3)C: Compliant, LC: Largely- Compliant, PC: Partially- Compliant, NC: Non-Compliant

Reference: Overview of revised FATF recommendations:

Documents - Financial Action Task Force (FATF) (fatf-gafi.org)From the viewpoint of the effectiveness of the AML/CFT/CPF system, whether effective measures are implemented regarding the following 11 Immediate Outcomes are evaluated.

IO: Immediate Outcome

Note: Effectiveness ratings can be either a High – HE, Substantial – SE, Moderate – ME, or Low – LE, level of effectiveness.

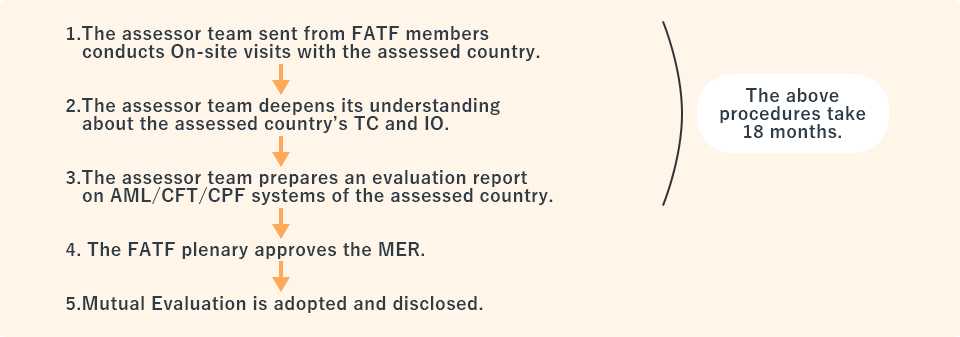

Mutual Evaluation Process

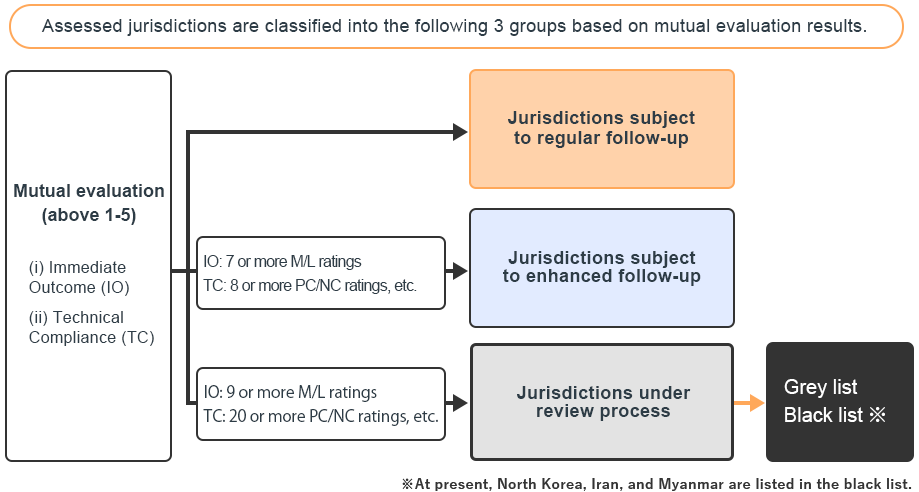

Assessed jurisdictions are classified into 3 groups based on the MER and required follow-up reports in line with the results. Through the follow-up process, assessed countries are expected to address the improvement of the matters pointed out in the TC & IO to globally enhance AML/CFT/CPF measures.

The following 2 elements are evaluated to ensure the implementation of the FATF standards.

(i) Effectiveness of legal systems (IO: Immediate Outcome, 11 items): 4 evaluation ratings from the highest to the lowest are given: HE → SE → ME → LE (Note 1)

(ii) Development of laws and regulations (TC: Technical Compliance, 40 items): 4 evaluation ratings from the highest to the lowest are given: C → LC → PC → NC (Note 2)(Note1) HE: High level of Effectiveness, SE: Substantial level of Effectiveness, ME: Moderate level of Effectiveness, LE: Low level of Effectiveness

(Note 2) C: Compliant, LC: Largely- Compliant, PC: Partially- Compliant, NC: Non-Compliant

-

Recent Topics

-

(i) Virtual assets

As virtual assets have been increasingly misused for ML and TF due to their nature of anonymity and easy cross-border transfers, the FATF in June 2019 finalized its Standards relating to Recommendation 15 and clarified that the FATF Standards are to be applied to financial activities regarding virtual assets.

At the same time, the FATF established the Virtual Asset Contact Group (co-chaired by the Japanese Financial Services Agency) under its Policy Development Group (PDG) to have dialogues with relevant industries and closely monitor their initiatives for compliance with the finalized Standards. The Contact Group has continuously reviewed the status and challenges regarding the global implementation of the FATF Standards for virtual assets and virtual asset service providers. In October 2021, the FATF released the updated Guidance for a Risk-Based Approach to Virtual Assets and Virtual Asset Service Providers to provide each jurisdiction and relevant industries with further guidance regarding how to apply the FATF Standards to this sector.

Given the rapid evolvement in the virtual asset area and the growing threats, including ransomware and sanctions evasion, the FATF urges all jurisdictions to implement the FATF Standards regarding virtual assets, in particular, the “travel rule”, as soon as possible. The FATF will also continue to monitor risks associated with virtual assets, including so-called stablecoins, P2P transactions, non-fungible tokens (NFTs), and decentralized finance (DeFi).

-

(ii) Proliferation Financing (PF)

The FATF recommendations currently require governments and business operators to assess risks regarding ML/TF/PF. The fifth round of mutual evaluation will require jurisdictions to assess the risk that those involved in the proliferation of weapons of mass destruction would attempt to evade financial sanctions. Business operators will also be required to take appropriate risk- mitigation measures.

The FATF has decided that the fifth round mutual evaluation will cover CPF measures based on risk assessment.

-

(iii) Enhancing transparency of Beneficial Ownership (BO)

As the Panama Papers (*) and the Pandora Papers (*) have unveiled the misuse of legal persons and arrangements to globally raise the awareness that efforts should be enhanced to identify the BO information of legal persons and legal arrangements, the FATF released a report on specific cases where legal persons and arrangements were misused through the concealment or fraudulent use of BO information.

* Panama Papers: The Panama Papers refer to documents that were leaked from a Panama-based law firm and published by the International Consortium of Investigative Journalists (ICIJ) in April 2016. These cases were related to 200 jurisdictions and the number of companies regarding which information was leaked came to 214,000. It was suspected that legal persons in offshore financial centers were used for tax evasion.

* Pandora Papers: The Pandora Papers as well were published by the ICIJ, including internal documents of law firms that established and managed companies in tax havens. They reportedly indicate that politicians, royal family members, and wealthy people around the world committed tax evasion and ML.

In response to the report, the FATF in March 2022 agreed on revisions to Recommendation 24 aiming to prevent the misuse of legal persons. The revisions call for various measures, including those that make it mandatory to establish mechanisms for registered and other public organizations to obtain information on the BO of legal persons.

In February 2023, the FATF also agreed on enhancements to Recommendation 25 on legal arrangements to bring its requirements broadly in line with those for Recommendation 24 on legal persons to ensure a balanced and coherent set of FATF standards on beneficial ownership. The FATF will begin assessing jurisdictions for implementation of the revised requirements at the start of the fifth round of mutual evaluations.

Reference:

Beneficial Ownership -

(iv) Environmental Crime

Given the reports 2020 ML and the Illegal Wildlife Trade and 2021 ML from Environmental Crime, the FATF intensively worked on ML relating to environmental crime. In October 2021, the FATF revised the definition of environmental crime (*), which is considered one of the predicate crimes, by providing the list of types of related crimes, in order to promote each jurisdiction’s understanding about environmental crime.

(*) Environmental crime – criminal harvesting, extraction or trafficking of protected species of wild fauna and flora, precious metals and stones, other natural resources, or waste.

-