AML/CFT/CPF in Japan

-

National Initiatives

- Initiatives led by the Government

-

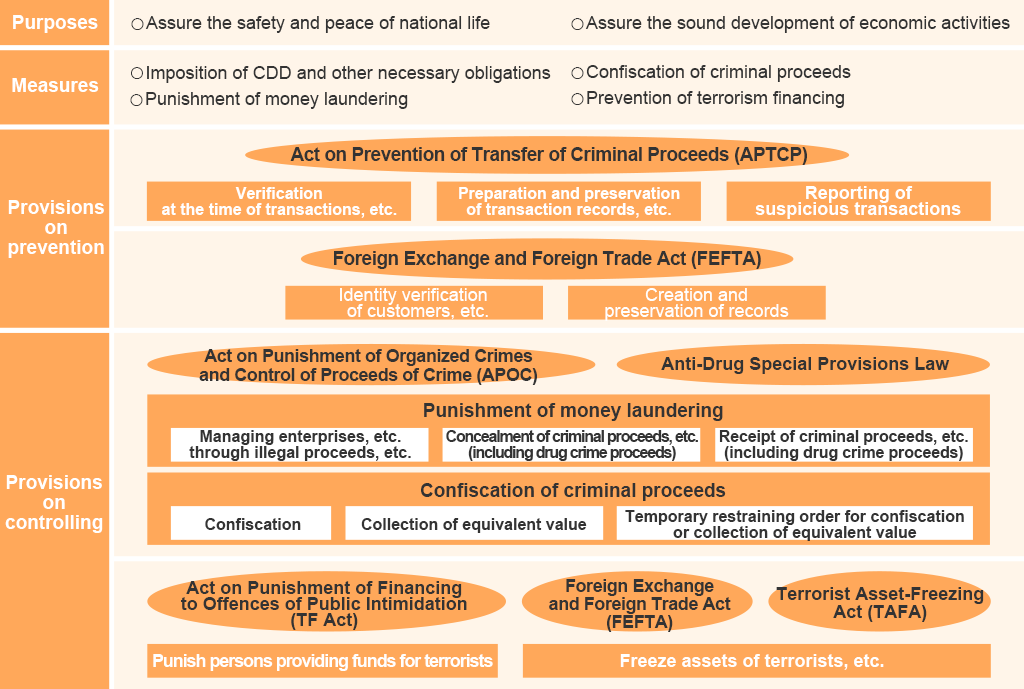

The Government of Japan has taken various measures, including the establishment of laws and regulations, and guidelines for AML/CFT/CPF measures to ensure safety and security of the country and citizens, and to maintain and develop a sound economy. It has promoted cooperation with foreign jurisdictions and international organizations to support AML/CFT/CPF measures in developing economies.

Crimes related to illicit financial flows have been more complicated and globalized. It is essential for Japan to constantly review relevant measures in response to global and domestic trends.

- The Inter-Ministerial Council for AML/CFT/CPF Policy

-

Taking the opportunity of the publication of the FATF’s Fourth Round of Mutual Evaluation Report of Japan, in August 2021, the Government of Japan established the Inter-Ministerial Council for AML/CFT/CPF Policy (the Council) chaired by the National Police Agency (NPA) and the Ministry of Finance (MOF) in order to strongly advance the Government’s measures as a whole.

Also, in August 2021, the Council formulated the AML/CFT/CPF Action Plan, and in May 2022, the Council issued the Strategic Policy towards Promoting AML/CFT/CPF. In April 2024, the Council formulated the National AML/CFT/CPF Action Plan (FY2024-26), and the progress of the efforts based on the Action Plan have been followed up by the Council. As the FATF has been revising its Standards toward the fifth round of mutual evaluation, it is important to take measures in order to meet the updated Standards in addition to addressing recommendations in the fourth round of mutual evaluation.

-

See: The Strategic Policy towards Promoting AML/CFT/CPF

See: The National AML/CFT/CPF Action Plan

See: The National AML/CFT/CPF Action Plan (FY2024-26)

See: Establishment of the Inter-Ministerial Council for AML/CFT/CPF PolicySee: Results of the FATF’s Fourth Round of Mutual Evaluation of Japan

See: Follow-Up Report Japan-2022

See: Follow-Up Report Japan-2023

See: Follow-Up Report Japan-2024- Inter-Ministerial Council for AML/CFT/CPF PolicyCochairs: NPA, MOF

-

- A joint-agency body of director-general level to develop, coordinate and promote national policies and actions regarding AML/CFT/CPF.

- The Council plays a leading role in formulating national policies and promoting implementation of the policies.

- It may hold subcommittees as necessary, which are responsible for specific individual policies in order to advance the implementation of AML/CFT/CPF.

Four pillars of AML/CFT/CPF regime in Japan:

- (ⅰ)Preventive measures by FIs and DNFBPs

- (ⅱ)Criminalizing ML and TF

- (ⅲ)Depriving criminal proceeds

- (ⅳ)Combating the financing of terrorism and countering proliferation financing

Source:NPA (Annual Report - 2022)

Overview of relevant acts

-

Act on Prevention of Transfer of Criminal Proceeds (APTCP)<Available in Japanese>

The law provides for preventive measures to combat ML/TF by imposing obligations on specified business operators to perform CDD, record keeping, filing STRs, etc.

-

Foreign Exchange and Foreign Trade Act (FEFTA)

The law aims to contribute to the sound development of the Japanese economy through minimum necessary controls and adjustments regarding external transactions. Regarding CFT/CPF measures, it calls for asset-freezing and other measures against terrorists and those involved in North Korea’s and Iranian proliferation financing, and it requires banks and other FIs to check whether customers’ remittances violate the FEFTA and verify customers’ identity.

-

Act on Punishment of Organized Crimes and Control of Proceeds of Crime (APOC)

The law has expanded the scope of predicate offences of the concealment of criminal proceeds, etc. to include certain serious crimes. It also provides for the confiscation and collection of an equivalent value of criminal proceeds, etc.

-

The law designates certain types of drug crimes as predicate offences for the concealing of drug crime proceeds and the law also provides for confiscating or forfeiting drug crime proceeds.

-

Act on Punishment of Financing to Offences of Public Intimidation (TF Act).

The law provides for punishment for the collection and provision of terrorist funds.

-

Terrorist Asset Freezing Act (TAFA)<Available in Japanese>

The law regulates domestic transactions by international terrorists etc., which the FEFTA does not cover.

-

-

Risk-Based Approach

Based on the Act on Prevention of Transfer of Criminal Proceeds (APTCP), the National Public Safety Commission prepares and publishes the National Risk Assessment-Follow-up Report (NRA-FUR), which specifies and assesses ML/TF risks for each category of transactions by specified business operators.

NRA-FUR conducts diverse and comprehensive risk assessment by analyzing ML cases, suspicious transaction reports and information held by relevant government agencies.

See: NRA-FUR

- (i) FIs: Financial institutions

-

In Japan, Financial institutions (FIs) refer to banks, life insurance companies, non-life insurance companies, financial instruments business operators, money lending business operators, fund transfer services providers, crypto-asset exchange service providers, currency exchange operators, etc.

Various financial services provided by these FIs are indispensable for our daily life and economic activities. Because of their convenience, however, there are risks that such services may be used by crime or terrorist organizations for disguising crime and other illegal trade proceeds as legitimate proceeds or for financing terrorists.

Therefore, FIs are required to take various risk reduction measures, including customer due diligence and the reporting of suspicious transactions, under the AML/CFT/CPF regime. Authorities supervise whether FIs comply with the requirement.

- (ii) DNFBPs: Designated Non-Financial Businesses and Professions

-

In Japan, Designated Non-Financial Businesses and Professions (DNFBPs *) are designated as specified business operators under the APTCP along with FIs.

As DNFBPs cover a wide range of industries as indicated below, the government identifies risks, formulates guidelines and conducts inspection and supervision in consideration of their sizes and characteristics. In the field of AML/CFT measures, DNFBPs have been a more important issue.

* DNFBPs:

real estate brokers, dealers in precious metals and stones, postal receiving service providers, telephone receiving and forwarding service providers, casino business operators and other business operators; lawyers, judicial scriveners, certified administrative procedures legal specialists, certified public accountants, certified public tax accountants and other specialists

- (iii)NPOs: Non-Profit Organizations

-

The FATF requires that CFT measures should be applied to non-profit organizations (NPOs) that are vulnerable to misuse for terrorist finance because of their social credibility and financial resources.

Given that the FATF defines NPOs as “a legal person or arrangement or organization that primarily engages in raising or disbursing funds for purposes such as charitable, religious, cultural, educational, social or fraternal purposes, or for the carrying out of other types of good works”, Japan’s CFT measures target not only corporations engaging in specified non-profit activities (CESNAs) but also public interest corporations, social welfare corporations, medical corporations, incorporated educational institutions and religious corporations.

-

Beneficial Ownership

As legal persons, while playing a key role in supporting commercial activities, can also be used to misuse for concealing illegally acquired assets, international arguments have recently grown for improving the transparency of Beneficial Ownership (BO) of legal persons to prevent their misuse.

*(Note)Beneficial Owner

The FATF defines beneficial owner as the natural person who ultimately owns or controls a legal person. In Japan, “Beneficial Owner” refers to the case when a natural person, etc. directly or indirectly holds more than one-fourth of the voting rights of a legal person. (Article 4, Paragraph 1-4, APTCP; Article 11, Paragraph 2, APTCP Enforcement Regulations)

In Japan, the following three measures are taken in regard to the information of BO to prevent the misuse of legal persons.

- (i) Obligation on FIs, etc. to perform verification at the time of transactions

-

FIs and other specified business operators are obliged to verify information about beneficial owners of corporate customers at the time of specified transactions with them. (Article 4, Paragraphs 1 and 2, APTCP; Article 11 and Article 14, Paragraph 3, Ordinance for Enforcement of the APTCP)

- (ii) Notaries’ verification of BO at the time of legal person incorporation

-

There is a system in which notaries before the certification of articles of incorporation for founding legal persons ask clients to report information on Beneficial Owners of the legal persons and verify that the Beneficial Owner does not fall into the category of members of an organized crime group or international terrorists (Article 13-4, Regulation of Enforcement of the Notary Act). Notaries issue relevant verification certificates at the request of clients.

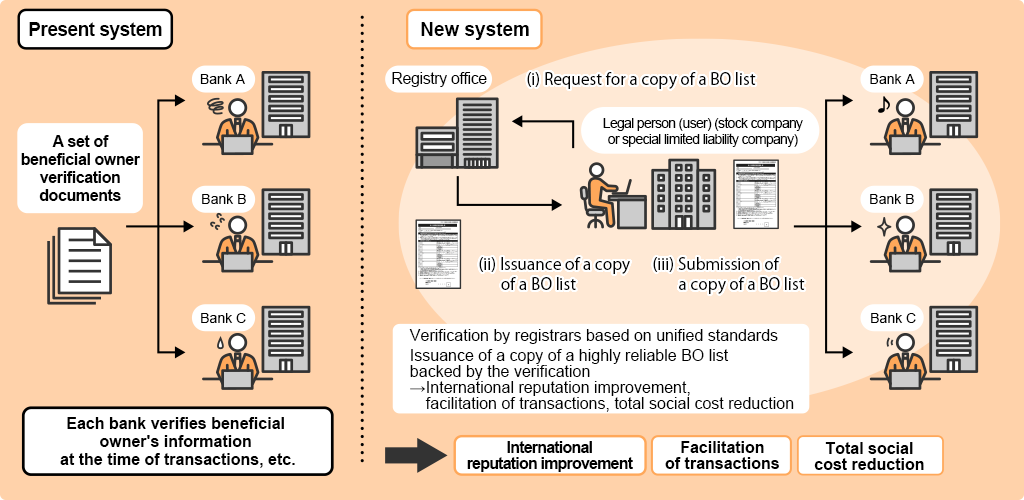

- (iii) Commercial Registry Offices’ the BO of Legal Persons List System

-

This system was to be enforced in January 2022 to specify that commercial registry offices can store documents containing information on BO of stock companies at the request and provide a copy of such documents in order to keep track of the Beneficial Owners after the establishment of companies.

●Overview of the BO of Legal Persons List System

Under the system, upon the request from a stock company, the registrar verifies the BO list (meaning a document that describes information on voting rights held by Beneficial Owners of the stock company) prepared by the stock company by prescribed attachments (including a copy of the shareholder register as of the request date) and issue a copy of the list.

-

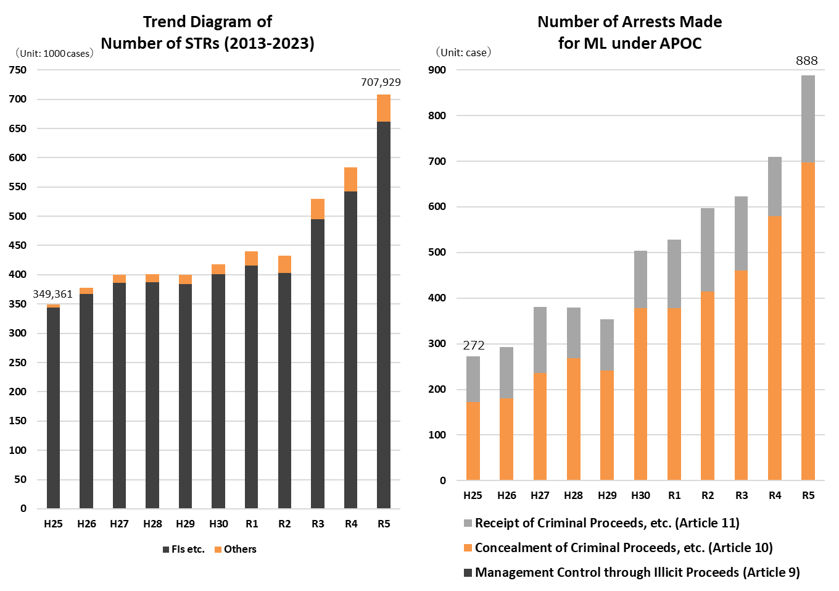

Utilization of FIU

-

A Financial Intelligence Unit (FIU) serves as a national center for the receipt and analysis of suspicious transaction reports and disseminates analysis results to law enforcement agencies.

Japan’s FIU, named Japan Financial Intelligence Center (JAFIC), collects, organizes, analyzes and disseminates information reported by FIs, etc. to law enforcement agencies in order to support the government’s AML/CFT measures. It has signed documents to establish a framework for information exchange with the FIUs in more than 100 foreign countries regarding AML/CFT measures.

See: NPA(Annual Report – 2023)

-

-

Enforcement and Asset Freezing

-

(i) Investigation, prosecution, etc.

ML/TF may foster organized crime and terrorism. Strict measures must be taken against ML/TF to prevent illegal money transfers.

Therefore, the Strategy to Make Japan the Safest Country in the World calls for using APOC, Anti-Drug Special Provisions Law, and other relevant laws to appropriately implement punishments for ML in order to ensure the thorough deprivation of the proceeds of crime, including the proceeds of drug crime, and prevent criminal proceeds from being used for maintaining and expanding criminal organizations including terrorism.

-

(ii) Asset freezing

In response to the September 2001 terrorist attacks in the United States and North Korea’s development of nuclear and other weapons of mass destruction, the United Nations Security Council adopted resolutions urging countries to freeze assets of terrorists including those related to Taliban and others involved in North Korea’s and Iran’s proliferation of weapons of mass destruction without delay.

Based on the resolutions, Japan has been implementing asset freezing measures to prevent funds and other assets from being used for and flowing to Taliban related parties and terrorists under the FEFTA and the TAFA. The FEFTA requires banks and other FIs to verify the legality of their transactions with their customers and secures the effectiveness of asset freezing measures.

See:

Economic sanctions and obtaining permissions procedures (MOF website)<Available in Japanese>

TAFA (NPA website)<Available in Japanese>

-