The Standard Rate of Consumption Tax: 10% from October 1, 2019

With the rapidly progressing aging population, the government expenditure for social security benefits has been increasing year by year, and social security expenditures now account for approximately one third of the total expenditures. Meanwhile, at the current Japanese fiscal condition, tax revenue is below the increased demand on budget, which results in relying on debt and deferring the burden to future generations. The purpose of the consumption tax rate hike is to secure stable revenue and to make a social security system for all generations which is sustainable for future generations.

The revenue from consumption tax rate hike is exclusively used for stabilizing and enhancing the Social Security System.

Reduced Tax Rate System (from October 1, 2019)

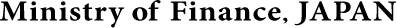

Considering the impact of the consumption tax rate hike on a lower income group, a reduced tax rate of 8% is applied to the supply of certain goods. The purpose of this scheme is to lessen the burden on household budgets through applying the reduced tax rate to the following goods:

- Foods and beverages with the exception of liquors and eating-out

- Subscribed newspapers issued twice or more per week

The coverage of foods and beverages which are subject to the reduced tax rate

- Like restaurant services, the 10% consumption tax rate is applied when you eat and/or drink at an eating space of suppliers including fast food chains and convenience stores. On the other hand, the taking out of food and/or beverages at those stores is subject to the reduced tax rate of 8%. To determine the applicable rates, you will be asked whether you will eat your foods and/or beverages at the store or take them out.

How shops/stores check the intention of customers on using eating space or taking out purchased foods and beverages

or