Structure of Income Tax of Japan (illustrative purposes only) | Types and Outlines of Personal Deductions | Outline of Other Income Deductions (Income Tax) | Tax Rate Structure of Income Tax

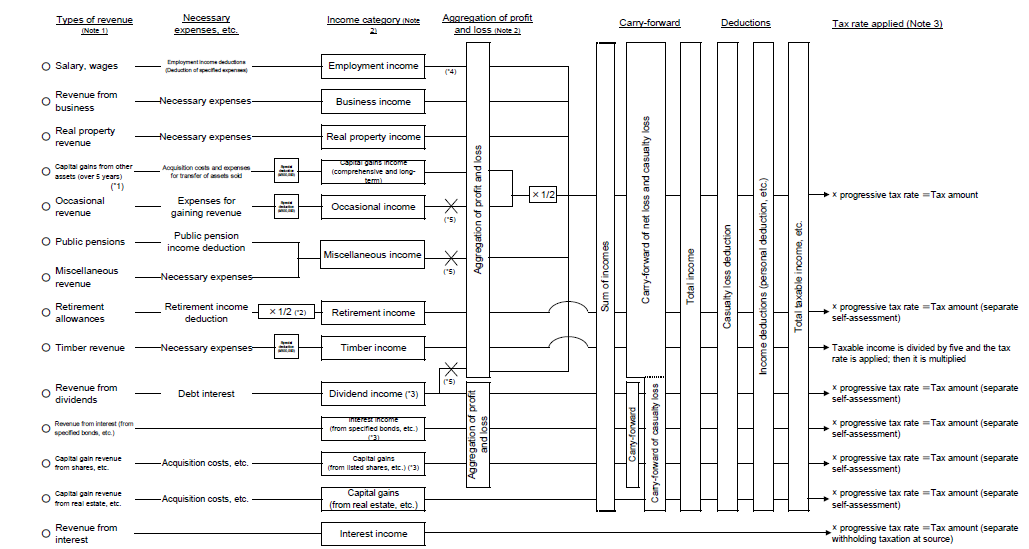

Structure of Income Tax of Japan (illustrative purposes only)

(Note 1) The major types of revenue are listed. Others include income related to futures trading. As for the taxation method for various incomes, separate withholding taxation at the source, separate self-assessment taxation, and other taxation may be applied in addition to the taxation method described above.

(Note 2) Certain special deductions, etc. may be applied to the calculation of various income amounts and taxable income amounts.

(Note 3) Suppose the amount calculated by multiplying the base income amount minus 330 million yen by the tax rate of 22.5% exceeds the amount of tax due. In that case, additional income tax equivalent to the amount of such excess is imposed (applicable to income tax for 2025 and onward).

(base income amount: the amount calculated by deducting the amounts relevant to carryover of loss and special deduction for capital gains (from real estate, etc.) from the sum of incomes including the amount, the payment of which are completed by only withholding tax as described in *3 below)

(base income amount: the amount calculated by deducting the amounts relevant to carryover of loss and special deduction for capital gains (from real estate, etc.) from the sum of incomes including the amount, the payment of which are completed by only withholding tax as described in *3 below)

(*1) "Capital gains from other assets" are capital gains arising from the transfer of assets other than land, buildings, and shares, etc.

(*2) The 1/2 taxation rule does not apply to retirement allowances (as for the retirement allowances paid to those other than corporate officers etc., it is limited to the portion of the allowance that exceeds three million yen after deducting the retirement income deduction) paid to those who have served for five years or less.

(*3) For dividend income, interest income from specified bonds, etc. and capital gains from listed shares, etc., tax payments may be completed by only withholding tax under certain conditions (filing a return is not required).

For dividend income from listed shares, etc., taxpayers can select either comprehensive taxation (dividend deduction is applicable) or separate self-assessment taxation when filing a return.

Capital gains and losses from listed shares, etc. can be aggregated with dividend income from listed shares, etc. and interest income from specified bonds, etc.

For dividend income from listed shares, etc., taxpayers can select either comprehensive taxation (dividend deduction is applicable) or separate self-assessment taxation when filing a return.

Capital gains and losses from listed shares, etc. can be aggregated with dividend income from listed shares, etc. and interest income from specified bonds, etc.

(*4) For taxpayers who have dependent relatives under 23 years of age or dependents with a particular disability, adjustment is made with deductions for income adjustment to avoid an increase in the tax burden due to the of lowering of the maximum income eligible for the employment income deduction to more than 8.5 million yen, which was made in the FY2018 revision.

For those who have both salaries and pensions, adjustment is made with the income amount adjustment deduction to avoid an increase in the burden of switching from deductions from employment income / public pensions to basic deductions, which was carried out in the FY2018 revision.

For those who have both salaries and pensions, adjustment is made with the income amount adjustment deduction to avoid an increase in the burden of switching from deductions from employment income / public pensions to basic deductions, which was carried out in the FY2018 revision.

(*5) The amount of loss related to these incomes shall not be aggregated with the amount of other incomes.

Types and Outlines of Personal Deductions

Outline of Other Income Deductions (Income Tax)

Tax Rate Structure of Income Tax

(Note) The amount of employment revenue of an employment income earner of a single-income household consisting

of a married couple and two children, one of whom falls within the category of specified dependent relative (age

19~23 years) and the other within the category of ordinary dependent relative (16~18 years or 23~70 years).