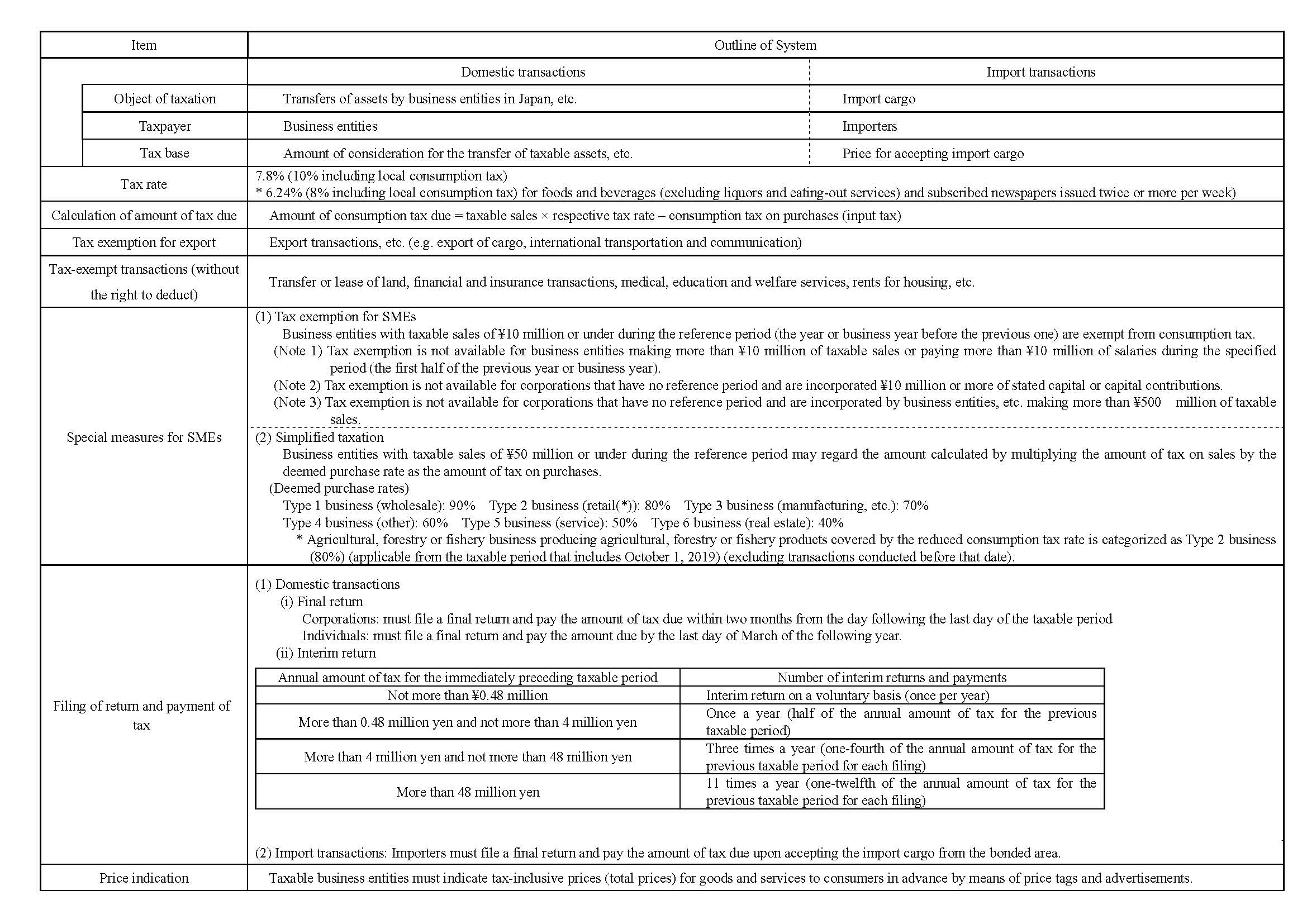

Outline of Consumption Tax

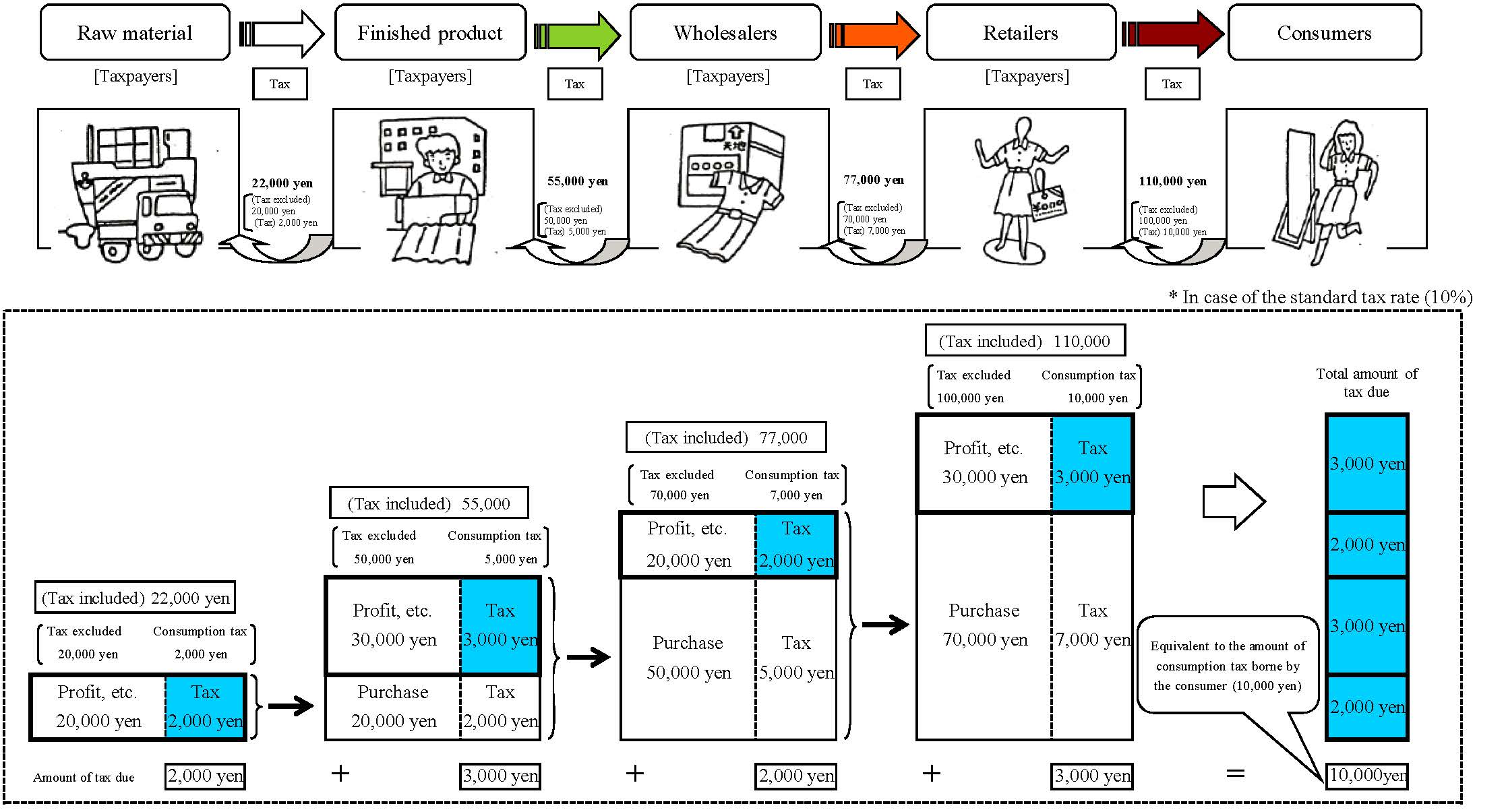

Structure of Multi-stage Taxation of Consumption Tax

○ Consumption tax is imposed with a focus on consumption of goods and services.

○ While the burden of consumption tax is imposed on final consumers, business entities are liable to pay the tax

to authorities.

○ The total amount of consumption tax paid by business entities in respective stages of each transaction, from

manufacturing to wholesale and retail, is equivalent to the total amount of consumption tax paid by

the consumer.

○ While the burden of consumption tax is imposed on final consumers, business entities are liable to pay the tax

to authorities.

○ The total amount of consumption tax paid by business entities in respective stages of each transaction, from

manufacturing to wholesale and retail, is equivalent to the total amount of consumption tax paid by

the consumer.

(Note) "Consumption tax" mentioned above includes the local consumption tax

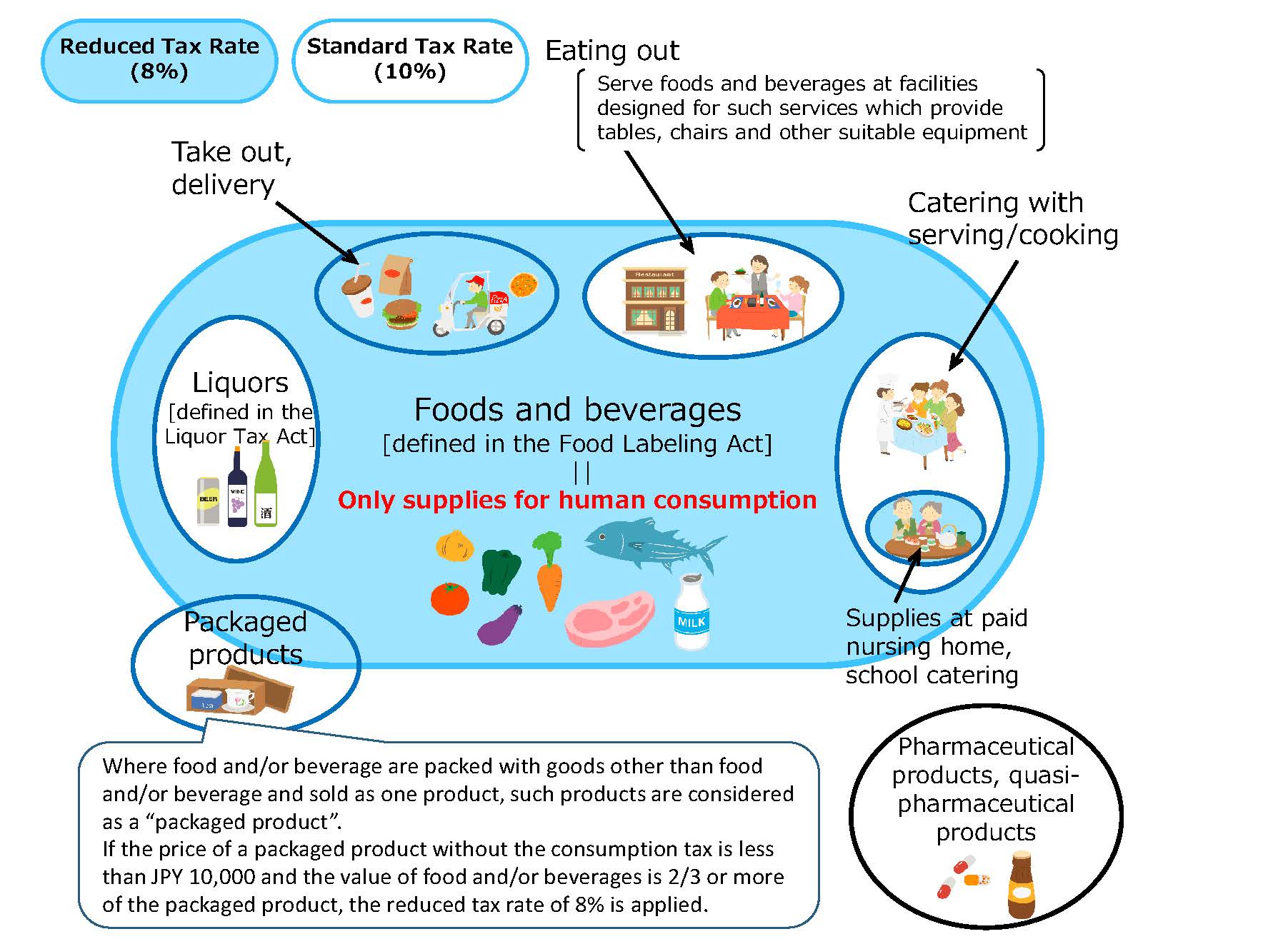

Outline of the Reduced Tax Rate System for Consumption Tax

The reduced tax rate system on the consumption tax is in operation from October 2019 to give considerations to the lower income group after the consumption tax hike. (in accordance with Article 7 of the Fundamental Tax Reform Act)

○ Items covered by the reduced tax rate - Foods and beverages excluding liquors and eating-out services

- Subscribed newspapers issued twice or more per week

○ Reduced tax rate: 8% (6.24% in national tax and 1.76% in local tax)

Standard tax rate: 10% (7.8% in national tax and 2.2% in local tax)

○ Introduction of the invoice-based method

- The invoice-based method introduced in October 2023.

- Business entities seeking input tax deductions are required to preserve invoices and keep related books. The

amount of tax deduction is calculated by totaling the amounts of tax written in the invoices or calculating the

amounts of tax based on the total amount of transactions.

(Transitional measures before the introduction of the invoice-based method)

- Implement measures to ensure separate accounting accounting on the reduced rate and the standard rate

respectively, while maintaining the current system of keeping commercial documents. Special rules will be

established for the calculation of the amount of tax on sales and tax on purchases.

(Transitional measures after the introduction of the invoice-based method)

- A partial deduction of input tax will be granted for purchases from tax-exempt business entities for a six-year period

after the introduction of the invoice-based method.