Ministry of Finance Japan

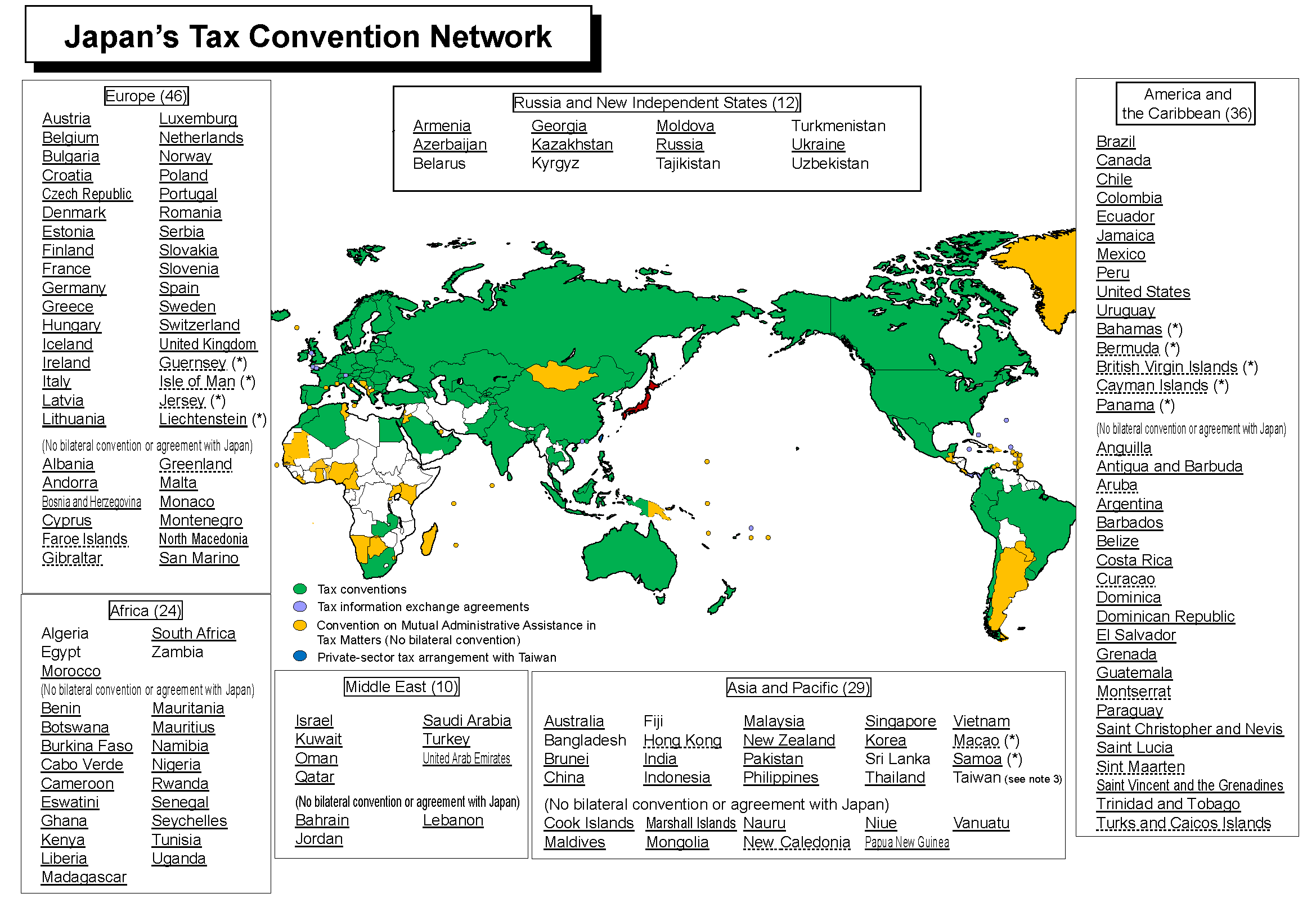

« 90 conventions, etc. applicable to 157 jurisdictions; as of February 1, 2026»(see notes 1 and 2)

(Note 1) Since the Convention on Mutual Administrative Assistance in Tax Matters is a multilateral convention, and the tax conventions with the former Soviet Union and with the former Czechoslovakia were succeeded by more than one jurisdiction, the numbers of jurisdictions do not correspond to those of tax conventions, etc.

(Note 2) The breakdown of the numbers of conventions, etc. and jurisdictions is as follows:

・Tax Conventions (conventions principally for the elimination of double taxation and the prevention of tax evasion and avoidance); 77 conventions applicable to 81 jurisdictions.

・Tax Information Exchange Agreements (agreements principally for the exchange of information regarding tax matters); 11 agreements applicable to 11 jurisdictions (these jurisdictions are marked with (*) above).

・Convention on Mutual Administrative Assistance in Tax Matters: entered into force by 127 jurisdictions (not including Japan) (these jurisdictions are underlined above) and applicable to 145 jurisdictions due to the extension of the application of the Convention (jurisdictions to which the Convention is extended are underlined above with dotted lines). 64 jurisdictions out of 145 do not have a bilateral convention or agreement with Japan.

・Private-sector Tax Arrangement with Taiwan: 1 jurisdiction

(Note 3) As for Taiwan, a framework equivalent to a tax convention is established in combination of (1) the Private-sector Tax Arrangement between the Interchange Association (Japan) and the Association of East Asian Relations (Taiwan) and (2) the Japanese domestic legislation to implement the provisions of the Private-sector Tax Arrangement in Japan.(The two associations are now renamed as the Japan-Taiwan Exchange Association (Japan) and the Taiwan-Japan Relations Association (Taiwan), respectively.)