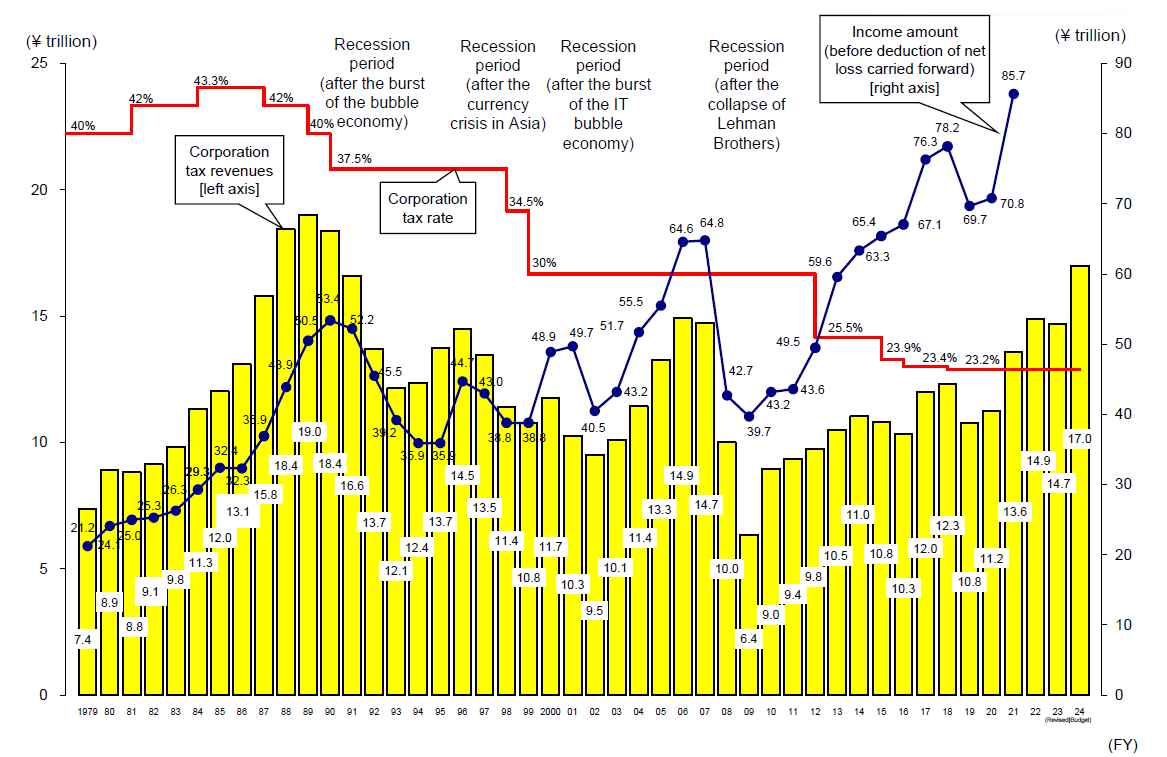

Trends in Corporation Tax Revenues

1. The data of corporation tax revenues: until FY2023: Settlement; FY2024: Based on the revised budget; FY2025: Based on the budget.

2. The income amount (before deduction of net loss carried forward) is based on the National Tax Agency's Corporate Sampling Survey. The data until FY2005 are based on business years that end between February 1 of the relevant year and January 31 of the next year, and data for FY2006 and thereafter are based on business years that end between April 1 of the relevant year and March 31 of the next year.