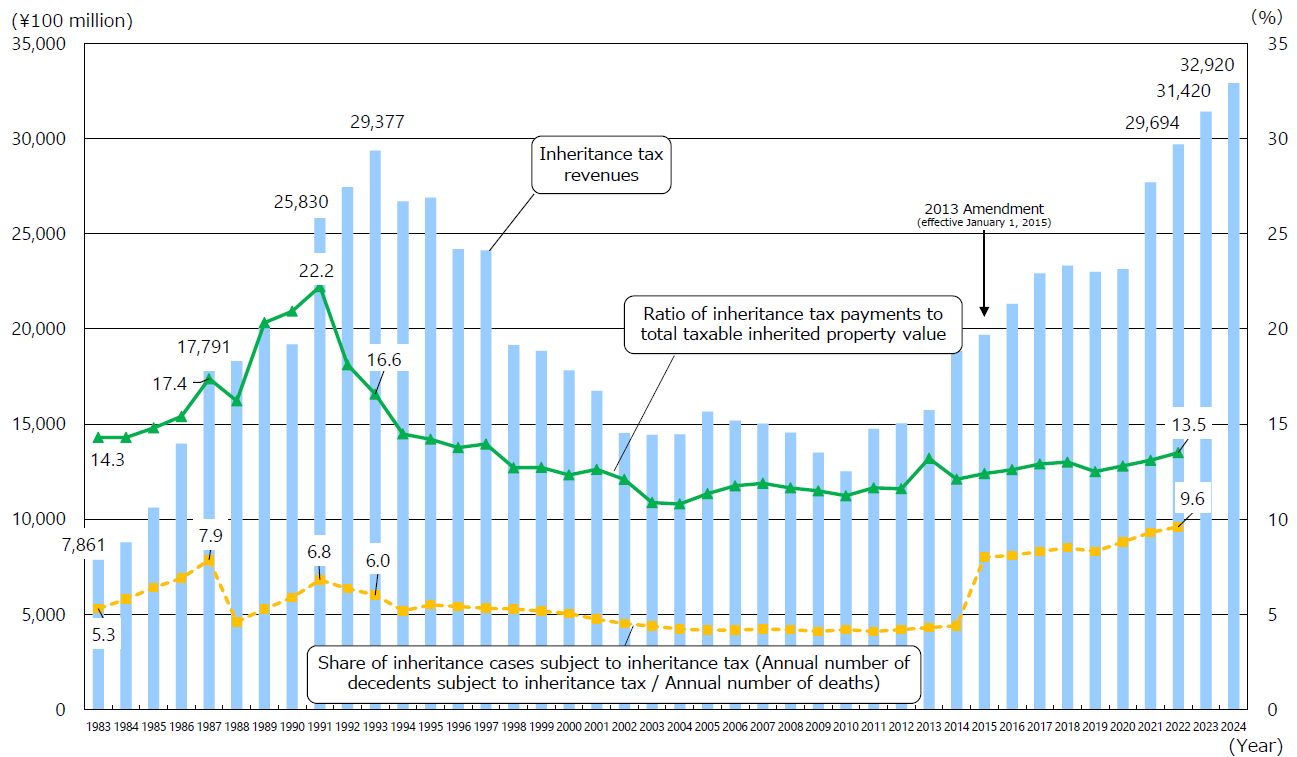

Changes in Inheritance Tax Revenues, Share of Inheritance Tax Cases, and Ratio of Tax Payments to Total Taxable Inherited Property Value

(Note 1) Inheritance tax revenues in the above graph are tax revenues in each fiscal year and include gift tax revenues (the data until FY 2023 are on a settlement basis, data in FY 2024 are on an estimated basis, and data in FY 2025 are on a budgeted basis).

(Note 2) The number of decedents subject to inheritance tax, inheritance tax payments, and total taxable inherited property value are based on the National Tax Agency’s Annual Statistics Reports, and the number of deaths is based on the Ministry of Health, Labour and Welfare’s Vital Statistics.

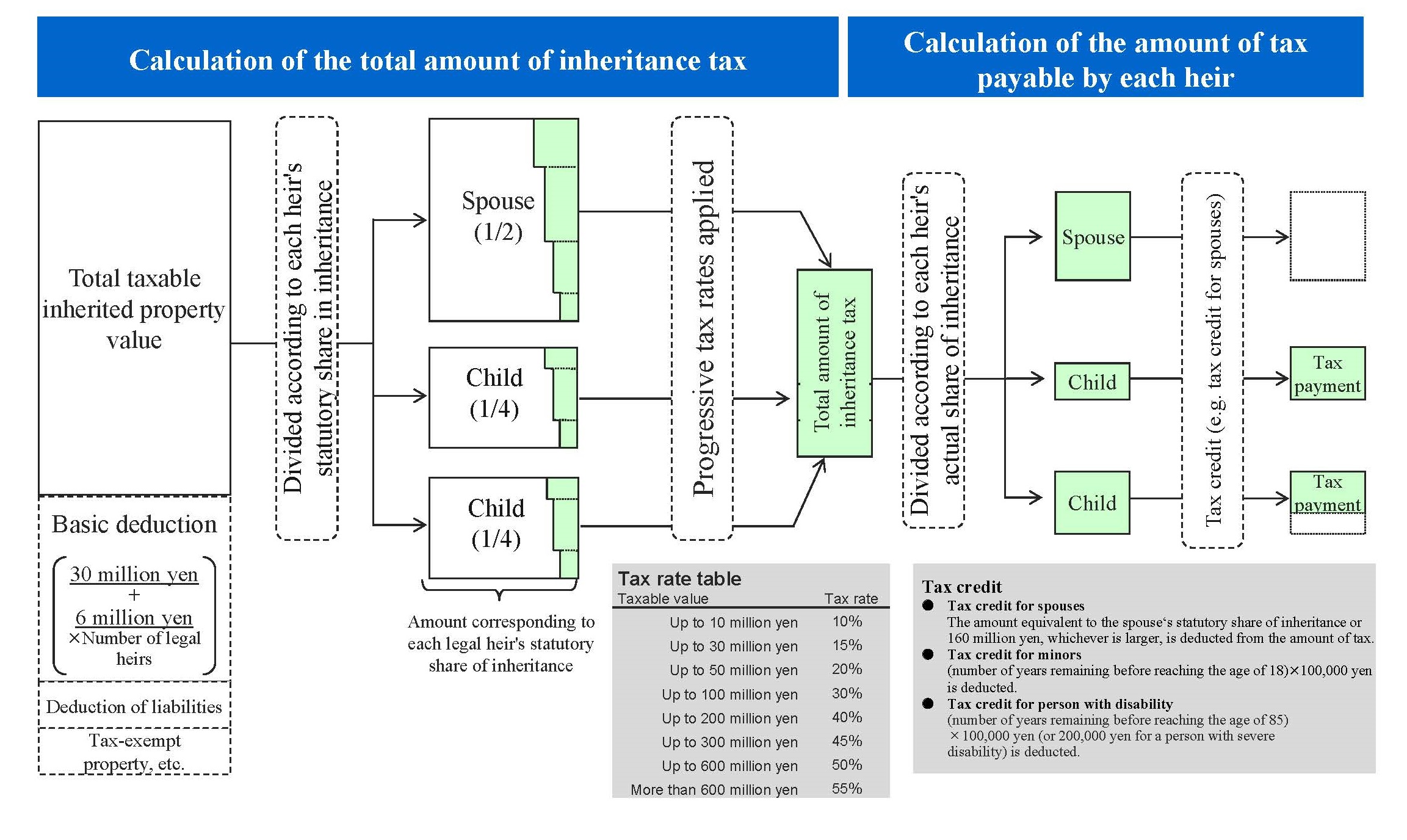

Structure of Inheritance Tax

Structure of Gift Tax (Calendar Year-based Taxation)

Gift tax is imposed on property that a taxpayer acquires as a gift from a private person, and the taxable value based on the market value of the property at the time of acquisition. It has as a supplementary effect to inheritance tax.

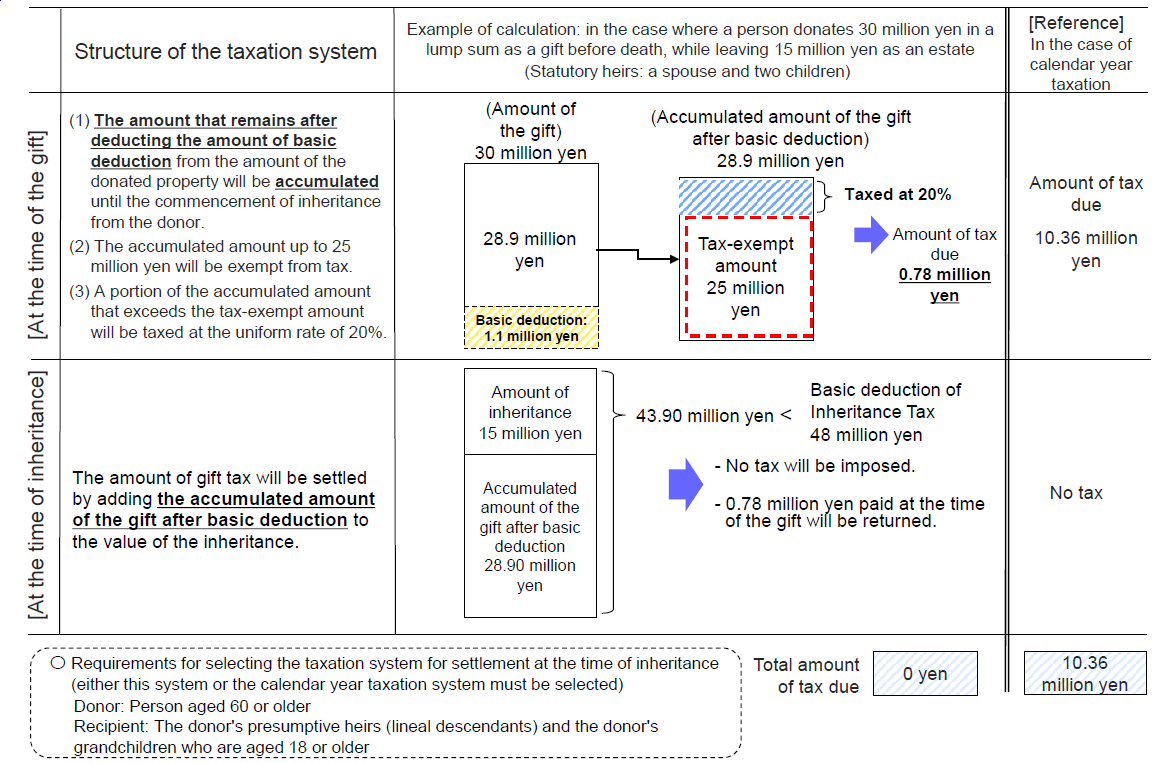

Structure of Gift Tax (taxation system for settlement at the time of inheritance)